MBA In Real Estate Management Elevating Your Career

MBA In Real Estate Management opens up a world of opportunities for aspiring professionals eager to make their mark in the real estate sector. This program not only equips students with essential skills and knowledge but also enhances their marketability in a competitive job landscape. With a core curriculum that blends theoretical and practical aspects of real estate, graduates can expect to tackle complex challenges and seize various career opportunities.

From financial analysis to ethical decision-making and innovative technology, this MBA program covers vital subjects that shape proficient real estate managers. By fostering networking skills and understanding global market dynamics, students are prepared to excel in various roles, from property management to real estate development.

Overview of MBA in Real Estate Management

An MBA in Real Estate Management equips students with the knowledge and skills needed to navigate the complexities of the real estate industry. This program is a crucial stepping stone for individuals looking to enhance their careers in various real estate sectors, including residential, commercial, and industrial markets. As the demand for qualified professionals continues to rise, pursuing an MBA in this field opens up numerous career opportunities, allowing graduates to thrive in leadership roles and make strategic decisions that influence property investments and developments.The curriculum of an MBA in Real Estate Management typically comprises a blend of core subjects and specialized courses designed to provide students with a solid foundation in business principles while also focusing specifically on real estate.

These courses are tailored to address the multifaceted nature of the real estate market.

Core Subjects in the Curriculum

The subjects covered in this program are essential for developing a comprehensive understanding of real estate management. Students will delve into various topics that combine theoretical knowledge with practical applications, fostering their analytical and decision-making abilities. The following core subjects are commonly included in the curriculum:

- Real Estate Economics: This course explores the economic principles governing real estate markets, including supply and demand dynamics and market analysis, helping students understand how economic factors affect property values.

- Real Estate Finance: Students learn about financing options, investment analysis, and financial modeling, which are crucial for evaluating potential real estate investments and understanding the financial implications of property transactions.

- Property Law: This subject covers legal principles related to real estate, including contracts, property rights, and regulatory frameworks, ensuring that students are well-versed in the legal aspects of real estate transactions.

- Urban Planning and Development: This course examines the processes involved in urban development, land use planning, and zoning regulations, enabling students to appreciate the broader context of real estate projects.

- Real Estate Marketing: Students study marketing strategies specific to real estate, learning how to effectively promote properties and attract potential buyers or tenants.

- Investment Analysis and Portfolio Management: This course focuses on assessing investment opportunities and managing a portfolio of real estate assets, teaching students how to optimize returns while mitigating risks.

Skills Developed through the Program

Completing an MBA in Real Estate Management allows students to cultivate a diverse skill set that is highly valued in the industry. The program emphasizes both technical and soft skills, equipping graduates to excel in various roles within the real estate sector. Key skills developed include:

- Analytical Skills: Graduates enhance their ability to analyze market trends, financial data, and investment opportunities, enabling them to make informed decisions.

- Negotiation Skills: Students learn effective negotiation techniques to navigate real estate transactions, ensuring favorable outcomes for all parties involved.

- Strategic Thinking: The program fosters strategic planning abilities, allowing graduates to develop long-term visions for real estate projects and investments.

- Leadership Skills: MBA programs emphasize leadership and management training, preparing students to lead teams and projects in various organizational settings.

- Communication Skills: Strong verbal and written communication skills are developed, essential for articulating complex ideas clearly to clients, colleagues, and stakeholders.

“The real estate market is continuously evolving; having a robust educational foundation provides a competitive edge.”

Career Opportunities in Real Estate Management

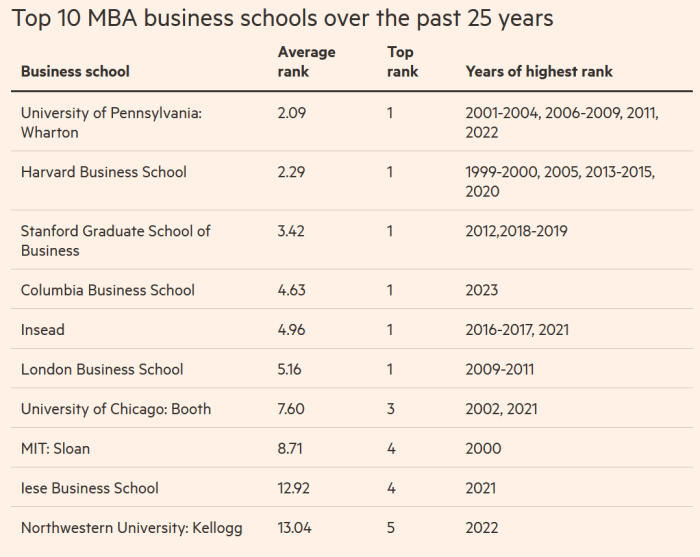

Source: clearadmit.com

The field of Real Estate Management offers a diverse array of career paths for graduates holding an MBA in this specialized area. With the real estate market continuously evolving, professionals in this sector can pursue various roles that cater to their skills, interests, and aspirations. This dynamic industry not only promises lucrative job opportunities but also allows individuals to make impactful contributions to urban development and community building.Graduates can find themselves working in various positions, ranging from analytical roles to hands-on management and strategic development.

Within the real estate sector, roles such as real estate analysts, property managers, and real estate developers are pivotal. Each role contributes uniquely to the lifecycle of real estate assets, requiring specific skill sets and expertise.

Roles in Real Estate Management

The following paragraphs delve into key roles available to MBA graduates in Real Estate Management, highlighting their responsibilities and significance within the industry:

1. Real Estate Analysts

These professionals are responsible for conducting research and analysis of real estate markets, trends, and investment opportunities. They evaluate property values and assess the financial performance of real estate investments. Analysts typically prepare detailed reports that inform investment decisions, guiding firms in identifying lucrative opportunities.

2. Property Managers

Property managers oversee the operations of residential, commercial, or industrial properties. Their responsibilities include tenant relations, maintenance coordination, budgeting, and ensuring compliance with local regulations. They focus on optimizing property performance while providing quality services to tenants and property owners.

3. Real Estate Developers

Developers are involved in the entire process of property development, from initial site acquisition to project completion. They work on residential, commercial, and mixed-use developments, managing everything from financing and zoning approvals to construction and marketing. Real estate developers play a crucial role in shaping communities and influencing urban landscapes.The following table Artikels potential employers in the real estate sector along with their respective job roles, illustrating the variety of opportunities available to MBA graduates in Real Estate Management:

| Employer | Job Role |

|---|---|

| Real Estate Investment Trusts (REITs) | Real Estate Analyst |

| Property Management Firms | Property Manager |

| Real Estate Development Companies | Real Estate Developer |

| Consulting Firms | Real Estate Consultant |

| Financial Institutions | Investment Analyst |

The real estate industry is known for its versatility and potential for professional growth, making it an attractive choice for those equipped with an MBA in Real Estate Management. The combination of analytical skills, management expertise, and market knowledge opens numerous avenues for career advancement in this vibrant field.

The Importance of Networking in Real Estate

Networking is an essential component of success in the real estate industry, where relationships often drive opportunities and influence. Building a strong professional network can significantly enhance your career prospects, providing access to invaluable resources and insights. Through effective networking, real estate professionals can cultivate connections that lead to job offers, partnerships, and mentorships, ultimately paving the way for career advancement.Establishing a professional network in real estate involves strategic actions and a proactive attitude.

Engaging with peers, mentors, and industry leaders can unlock doors to new opportunities and collaborations. One of the most effective ways to foster these connections is through a variety of networking methods that allow you to meet individuals across different sectors of real estate.

Strategies for Building a Professional Network

The following strategies can significantly enhance your networking efforts within the real estate industry:

- Attend Industry Events: Participating in conferences, seminars, and workshops is a prime opportunity to meet professionals and experts in real estate. These gatherings facilitate meaningful conversations and provide insights into market trends.

- Join Professional Associations: Becoming a member of organizations like the National Association of Realtors (NAR) or the Urban Land Institute (ULI) connects you with like-minded individuals and offers access to exclusive resources and events.

- Utilize Social Media: Platforms such as LinkedIn serve as an excellent space to network with industry professionals. Regularly sharing articles, insights, and engaging with others’ posts can enhance your visibility and foster relationships.

- Participate in Local Networking Groups: Engaging with local real estate meetups or investment clubs can provide a more personal touch to networking, allowing for direct interactions with potential partners and mentors.

Networking is not only about making connections but also about nurturing them over time. Establishing genuine relationships based on trust and mutual benefit can lead to fruitful job opportunities and collaborations.

“Your network is your net worth.”

Networking Leading to Job Opportunities and Business Partnerships

The interplay between networking and career advancement in real estate is evident through various avenues. Many job opportunities arise from personal connections rather than traditional job postings. Building relationships with industry professionals can lead to referrals or insider knowledge about job openings.Business partnerships also stem from networking efforts. When professionals share similar goals and values, they can collaborate on projects that benefit both parties.

For instance, a real estate agent who networks with a mortgage broker can create a referral system, leading to increased business for both.Moreover, networking allows professionals to stay informed about industry trends and changes, enabling them to adapt and seize new opportunities. Engaging with others in the field can provide insights into market demands, regulatory changes, and emerging technologies, which are crucial for strategic decision-making.In conclusion, effective networking in real estate is about building and maintaining relationships that can lead to exciting career opportunities and partnerships.

Through strategic engagement and continuous relationship management, professionals can position themselves for success in this dynamic industry.

Trends in Real Estate Management Education: MBA In Real Estate Management

The landscape of real estate management education is rapidly evolving, driven by technological advancements and changing market demands. As prospective students and professionals seek more flexible and modern learning options, educational institutions are adapting their programs to align with these expectations. This section delves into the latest trends that are shaping real estate management education today.

Growth of Online and Hybrid Learning

The increasing demand for flexible learning has seen a significant rise in online and hybrid programs in real estate management. These formats allow students to balance their studies with work responsibilities, making education more accessible. Online programs utilize advanced learning management systems to deliver content and facilitate interaction, while hybrid programs combine traditional classroom experiences with online components. Key benefits of these learning methods include:

- Flexibility: Students can learn at their own pace and on their own schedule.

- Accessibility: Online programs can reach a wider audience, including international students.

- Cost-Effectiveness: Reduced commuting and accommodation costs make education more affordable.

Comparing Traditional and Modern Teaching Methods

Traditional teaching methods in real estate management often focus on face-to-face instruction and textbook learning, while modern teaching approaches emphasize interactive and experiential learning. Modern methods include:

- Case Studies: Real-world scenarios that help students apply theoretical knowledge.

- Simulations: Virtual environments where students can practice decision-making in real estate transactions.

- Collaboration Tools: Use of platforms like Zoom and Slack to foster teamwork and communication among students.

The shift towards experiential learning is aimed at preparing students for the dynamic nature of the real estate market.

Integration of Technology and Tools

Technological advancements are being integrated into real estate management education to enhance learning experiences. Key technologies include:

- Virtual Reality (VR): Used for property tours and immersive learning experiences.

- Data Analytics: Teaching students how to analyze market trends and property data effectively.

- Property Management Software: Familiarizing students with tools like Yardi and AppFolio to manage real estate portfolios.

These technologies not only enrich the educational experience but also equip students with essential skills that are highly valued in the job market. As the industry continues to evolve, staying abreast of these trends ensures that graduates are well-prepared for their careers in real estate management.

Financial Aspects of Real Estate Management

Understanding the financial aspects of real estate management is essential for professionals aiming to excel in the industry. Financial principles provide the foundation for making informed decisions that affect the profitability and viability of real estate investments. From investment analysis to property valuation, these principles are crucial for navigating the complexities of real estate transactions and asset management.The financial landscape of real estate management encompasses various principles that guide investment decisions, risk assessments, and financial reporting.

Knowledge of financial metrics is vital for evaluating the performance of real estate assets and understanding market trends. Real estate professionals utilize a variety of financial analysis techniques to assess property values, forecast potential returns, and make strategic investment choices.

Financial Analysis Techniques in Real Estate

A comprehensive understanding of financial analysis techniques is crucial for success in real estate management. These techniques enable professionals to evaluate investments and determine the best strategies for maximizing returns. Below is a list of key financial analysis techniques employed in the industry:

- Net Present Value (NPV): A method used to assess the profitability of an investment by calculating the present value of expected cash flows minus the initial investment cost.

- Internal Rate of Return (IRR): The discount rate that makes the NPV of all cash flows equal to zero, providing insight into the efficiency of an investment.

- Cash-on-Cash Return: A measure of the return on an investment based on the cash income earned relative to the cash invested.

- Capitalization Rate (Cap Rate): A metric used to evaluate the potential return on an investment property by dividing the net operating income (NOI) by the property’s purchase price.

- Debt Service Coverage Ratio (DSCR): A ratio used to assess a property’s ability to generate enough income to cover its debt obligations, calculated by dividing the NOI by total debt service.

Investment analysis and property valuation are at the heart of real estate management. Accurate valuation of properties ensures that investments are made wisely, reflective of current market conditions and future potential.

Investment Analysis and Property Valuation

The significance of investment analysis and property valuation cannot be overstated in real estate management. These processes help investors make data-driven decisions and mitigate financial risks. Investment analysis involves assessing both the financial metrics and the qualitative aspects of real estate opportunities.Property valuation methods, such as the sales comparison approach, income approach, and cost approach, allow professionals to determine market value based on different criteria.

“Accurate property valuation is not just about numbers; it reflects an understanding of market dynamics and future trends.”

Investment analysis helps in identifying underperforming assets and potential opportunities for growth. For instance, a thorough analysis might reveal that a property located in a high-demand area, despite initial high costs, could yield substantial returns due to appreciation and rental demand over time. In essence, mastering financial principles, utilizing analysis techniques, and performing rigorous valuation processes are essential for anyone looking to thrive in real estate management.

These elements work together to create a holistic understanding of the financial landscape within the industry.

Global Perspectives in Real Estate Management

The real estate landscape is not a monolith; it varies significantly across different countries, shaped by unique economic, cultural, and regulatory factors. Understanding these differences is crucial for professionals aiming to navigate the complexities of global real estate management. This section delves into the variances in real estate markets around the world, the impact of global economic dynamics on local markets, and the challenges and opportunities that arise for real estate managers operating internationally.

Differences in Real Estate Markets

Real estate markets around the world exhibit distinct characteristics influenced by local laws, cultural attitudes, and economic conditions. For instance, in the United States, a high emphasis on property ownership drives a robust single-family home market, while in many European countries, such as Germany, renting is culturally preferred, resulting in a strong rental market. Additionally, emerging markets, such as India and Brazil, are witnessing rapid urbanization, leading to a surge in demand for commercial and residential properties.

The regulatory environment also plays a significant role in shaping these markets. For example, countries like Singapore have stringent regulatory frameworks that govern property transactions, while in others, such as Thailand, foreign ownership limitations can restrict international investment. Understanding these nuances helps real estate managers to strategize effectively and adapt to local conditions.

Global Economic Factors Influencing Local Markets

Several global economic factors can significantly influence local real estate markets. Economic indicators such as GDP growth, employment rates, and interest rates serve as key determinants of real estate demand and pricing. The correlation between economic health and real estate is evident in regions experiencing economic booms, where increased income levels spur property purchases and investment.Moreover, geopolitical events, such as trade agreements and conflicts, can also sway market dynamics.

For instance, the recent trade agreements in the Asia-Pacific region have led to increased foreign investment in real estate, particularly in commercial sectors.

“Real estate is fundamentally local, but its performance can be heavily influenced by global economic conditions.”

Challenges and Opportunities in International Real Estate Management

Operating in an international real estate context presents unique challenges and opportunities for managers. One primary challenge is navigating varying legal frameworks, which can complicate transactions and lead to compliance issues. Additionally, cultural differences may impact negotiation styles and client expectations, requiring a nuanced approach to relationship management.On the other hand, international exposure opens up diverse investment opportunities. Managers can leverage knowledge from different markets to identify trends and innovative practices that can be adapted locally.

For example, the concept of mixed-use developments, popularized in urban centers around the world, is increasingly being adopted in markets like the Middle East, enhancing community living and maximizing property utility.Furthermore, advancements in technology and data analytics offer real estate managers tools to gain insights into market trends across borders, allowing them to make more informed decisions. Leveraging platforms that aggregate global real estate data can provide a competitive edge in identifying lucrative investment opportunities.Overall, the intersection of global insights and local market understanding is essential for successful real estate management in a rapidly evolving world.

Ethical Considerations in Real Estate

Source: meridean.org

In the dynamic field of real estate management, professionals often face complex ethical dilemmas that can influence their decisions and long-term success. As the industry continues to evolve, understanding the ethical landscape becomes increasingly important. This section highlights common ethical challenges in real estate and emphasizes the importance of ethical practices in establishing a sustainable business.Ethical dilemmas frequently encountered in real estate management include issues related to transparency, conflicts of interest, and discrimination.

Agents may be tempted to prioritize their commissions over their clients’ best interests, leading to a breakdown of trust. Furthermore, the pressure to close deals can lead to misrepresentation of property conditions or market values. Discrimination based on race, gender, or socioeconomic status remains a significant concern, undermining the integrity of the industry.

Importance of Ethical Practices in Building a Sustainable Real Estate Business

Maintaining ethical practices is essential for fostering trust and credibility in real estate. Ethical behavior enhances reputation, attracts clients, and encourages repeat business. The following points illustrate the significance of ethics in real estate:

- Trust-Building: Ethical practices cultivate long-lasting relationships with clients and partners, leading to referrals and repeat business.

- Risk Management: Adhering to ethical standards minimizes legal risks associated with fraud, discrimination, and misrepresentation.

- Market Reputation: A strong ethical reputation differentiates a business from competitors, attracting clients who value integrity.

- Community Impact: Ethically conscious businesses contribute positively to the community, enhancing local reputation and goodwill.

Framework for Making Ethical Decisions in Real Estate Transactions

To navigate ethical dilemmas effectively, real estate professionals can adopt a structured framework for decision-making. This framework consists of several key steps that promote ethical outcomes:

1. Identify the Ethical Dilemma

Recognize the specific ethical issue at hand, considering the stakeholders involved.

2. Gather Information

Collect relevant facts that may impact the decision, including laws, regulations, and company policies.

3. Evaluate Alternatives

Assess potential courses of action based on their ethical implications, considering both short- and long-term consequences.

4. Make a Decision

Choose the alternative that aligns best with ethical standards and values, prioritizing integrity and responsibility.

5. Implement and Reflect

Execute the decision and later reflect on the outcomes, learning from the experience to inform future decisions.

“Ethics is knowing the difference between what you have a right to do and what is right to do.”

This framework provides a systematic approach to ethical decision-making, helping real estate professionals navigate the complexities of their roles while maintaining a commitment to ethical standards. By prioritizing ethics, practitioners can build not only a successful career but also contribute to a more responsible and sustainable real estate industry.

Real Estate Technology and Innovation

Source: jwplayer.com

The real estate industry is undergoing a significant transformation driven by technological advancements and innovative practices. These developments are reshaping how properties are managed, bought, and sold, with a focus on efficiency, transparency, and enhanced customer experiences. As technology continues to evolve, it becomes increasingly crucial for professionals in real estate management to stay informed and adapt to these changes.One of the most impactful areas of technology in real estate is the integration of data analytics into decision-making processes.

By leveraging vast amounts of data, real estate managers can make informed decisions that enhance operational efficiency and contribute to better investment outcomes. Data analytics enables professionals to analyze market trends, assess property values, and understand tenant behavior, which fosters more strategic planning and execution.

Technological Advancements in Real Estate Management, MBA In Real Estate Management

Recent advancements in technology are significantly influencing the real estate sector. The following innovations are key to transforming how properties are managed and marketed:

- Artificial Intelligence (AI): AI is being utilized for predictive analytics, helping managers forecast market trends and tenant needs. Chatbots powered by AI also enhance customer service by providing instant responses to inquiries.

- Blockchain Technology: Blockchain ensures transparency and security in transactions. It streamlines the process of property transfers and helps in maintaining secure records of ownership and lease agreements.

- Virtual and Augmented Reality (VR/AR): VR and AR technologies offer immersive property viewing experiences, allowing potential buyers and tenants to explore properties from the comfort of their homes, thus enhancing the marketing efforts.

- Property Management Software: Tools like Yardi and Buildium automate various aspects of property management, from tenant screening to maintenance requests, improving operational efficiency.

- Smart Home Technology: Integrating smart devices in properties increases appeal and occupancy rates, providing both convenience and energy efficiency for tenants.

Role of Data Analytics in Real Estate

Data analytics plays a pivotal role in enhancing decision-making processes in real estate management. By harnessing big data, real estate professionals can gain insights that drive strategic decisions. The importance of this can be summarized in the following points:

- Market Analysis: Data analytics helps in identifying emerging trends, allowing managers to adjust their strategies accordingly and stay ahead of the competition.

- Revenue Optimization: Analyzing rental data can guide pricing strategies, ensuring that properties are competitively priced to maximize occupancy and revenue.

- Risk Assessment: Advanced analytics tools enable managers to assess potential risks associated with investments, leading to more informed decision-making.

- Tenant Insights: Understanding tenant preferences and behaviors through data can improve tenant satisfaction and retention rates.

Innovative Tools and Platforms

Several innovative tools and platforms are enhancing property management and investment strategies. These solutions provide real estate professionals with the resources needed to optimize their operations:

- CoStar: This platform offers comprehensive commercial real estate information and analytics, aiding investors and managers in making sound decisions.

- Reonomy: A data platform that provides insights into commercial real estate ownership and financing, helping users to identify investment opportunities.

- TenantCloud: A property management software that simplifies tenant management processes, from lease agreements to rent collection.

- Archistar: This tool uses AI to streamline the design and development process, helping developers create optimal building designs based on data analytics.

- Rently: This innovative platform allows for self-showings, enhancing the experience for prospective tenants and improving efficiency for property managers.

“Data is the new oil; it’s valuable, but if unrefined, it cannot really be used.” – Clive Humby

Final Review

In summary, pursuing an MBA In Real Estate Management is a strategic move for anyone looking to thrive in the dynamic real estate industry. With a comprehensive curriculum and strong emphasis on networking, financial acumen, and ethical practices, graduates are well-positioned to navigate the challenges and opportunities of the market. Embarking on this educational journey not only enhances personal growth but also lays the groundwork for a rewarding career.

Helpful Answers

What is the duration of an MBA in Real Estate Management?

The duration typically ranges from one to two years, depending on the program structure and whether it is pursued full-time or part-time.

Is it necessary to have a background in real estate to enroll?

No, many programs welcome students from diverse academic backgrounds, as they value varied perspectives.

What types of projects do students undertake during the program?

Students often engage in case studies, group projects, and real-world simulations to apply their learning practically.

Are online MBA programs available for Real Estate Management?

Yes, many universities now offer online MBA programs that allow for flexible learning tailored to student schedules.

What are some key skills acquired through this MBA?

Students develop skills in financial analysis, strategic planning, negotiation, and ethical decision-making essential for real estate professionals.