MBA Course Fees Understanding Costs and Investments

MBA Course Fees sets the stage for an insightful journey into the financial aspects of pursuing a Master of Business Administration. As prospective students weigh their options, understanding the range of fees associated with MBA programs is crucial in making informed decisions. This discussion delves into various factors influencing course fees, additional costs to anticipate, and how financial aid options can alleviate the financial burden.

From tuition fees that vary by institution and program type to hidden costs that often catch students off guard, this overview aims to unearth all relevant information about MBA course fees. By analyzing trends and ROI, we hope to provide a comprehensive understanding of what students can expect when investing in their education.

Overview of MBA Course Fees

MBA programs are a significant investment in one’s education and future career. Understanding the fee structures associated with these programs is essential for prospective students. The typical fee range for MBA programs varies widely around the globe, influenced by several factors including the institution’s reputation, location, and the specific curriculum offered.The cost of MBA programs can range from a few thousand dollars to over $200,000 depending on various elements.

In general, students can expect to pay between $20,000 to $150,000 for their entire program. Top-tier business schools, particularly in the United States and Europe, often charge premium fees. In contrast, institutions in developing regions may offer more affordable tuition rates.

Factors Influencing MBA Course Fees

Multiple factors contribute to the variability in MBA tuition costs across different regions and institutions. Understanding these elements can help students make informed decisions about their education. The following points highlight some of the key influences on MBA course fees:

- Geographic Location: Institutions located in major urban centers typically have higher living costs and tuition fees compared to those in rural areas.

- Reputation and Accreditation: Schools with strong brands and accreditation from recognized bodies often charge higher fees due to the perceived value they offer.

- Program Length and Structure: Intensive programs or those that offer dual degrees may have different pricing structures, affecting overall costs.

- Course Delivery Format: Online or part-time programs can offer more flexible options and often vary in cost compared to traditional full-time programs.

- Scholarship Opportunities: Availability of financial aid and scholarships can significantly reduce the net cost for students.

Common Additional Costs Associated with MBA Programs

While tuition is a primary consideration, prospective students should be aware of additional costs that can arise during their MBA journey. These extra expenses can significantly impact the overall financial commitment required. The following list Artikels common additional costs students may encounter:

- Textbooks and Course Materials: Depending on the program, students may need to budget for books, software, and other educational resources.

- Travel Expenses: Students participating in international study trips or internships should account for travel and accommodation costs.

- Networking Events and Conferences: Fees for attending industry events can add up, but they are critical for building professional connections.

- Living Expenses: Costs associated with housing, food, and utilities can vary greatly depending on the location of the institution.

- Miscellaneous Fees: Additional charges for registration, graduation, and student services may also apply.

“Investing in an MBA is not just about tuition; it’s about the total cost of your education and the value you gain from it.”

Breakdown of Costs Involved: MBA Course Fees

Understanding the costs associated with pursuing an MBA is crucial for students and professionals considering this path. The financial commitment extends beyond tuition fees, encompassing various additional expenses. A detailed breakdown will clarify the overall investment required for an MBA program, aiding prospective students in making informed decisions.

Tuition Fees

Tuition fees represent the primary expense for MBA students, varying significantly based on the institution and the specific program. Below is a summary of typical tuition costs, illustrating the financial commitment per semester or per credit.

- Public Universities: Tuition typically ranges from $10,000 to $25,000 per year.

- Private Universities: Costs can range from $30,000 to $70,000 annually.

- Online Programs: Generally range from $15,000 to $50,000 total program cost.

The following table compares the MBA tuition fees across several notable institutions, illustrating the financial landscape students should consider:

| Institution | Tuition Fees (Annual) |

|---|---|

| Harvard Business School | $73,440 |

| Stanford Graduate School of Business | $74,706 |

| Wharton School, University of Pennsylvania | $81,378 |

| Columbia Business School | $80,000 |

| MIT Sloan School of Management | $77,168 |

Administrative and Registration Fees

In addition to tuition costs, students should be aware of various administrative and registration fees that can add to the overall financial burden. These fees often include:

- Application Fee: Typically ranges from $50 to $200.

- Registration Fee: Usually around $100 to $300 per semester.

- Technology Fee: Generally $100 to $500 annually, covering online resources and software.

- Student Services Fee: This can range from $200 to $1,000, depending on the institution’s offerings.

These fees are essential for maintaining the operational and technological aspects of the MBA program, ensuring students have access to necessary resources.

“It is crucial for prospective MBA students to consider both tuition and additional fees to develop a comprehensive understanding of the overall investment.”

Financial Aid Options

Financing an MBA can be a significant undertaking, but various financial aid options can help alleviate the burden. Understanding available scholarships, loan options, and the application processes can empower students to make informed decisions about funding their education. Here’s a breakdown of the primary financial aid avenues for MBA students.

Scholarship Opportunities

Scholarships play a crucial role in reducing the overall cost of an MBA program and are typically awarded based on merit, need, or specific criteria set by the offering institution. Many business schools offer scholarships to attract talented students.

- Merit-Based Scholarships: These are awarded based on academic performance, professional achievements, or leadership potential. For instance, schools like Harvard and Stanford offer substantial merit scholarships to exceptional candidates.

- Need-Based Scholarships: Designed for students who demonstrate financial need, these scholarships can significantly lessen tuition costs. Schools often require comprehensive financial information to assess need.

- Specialized Scholarships: Many institutions provide scholarships for underrepresented groups, such as women, minorities, or veterans. Programs like the Forté Fellowship support women pursuing an MBA.

Government and Private Loan Options

Loans are a common method for financing an MBA and come from both government and private sources. Each option has its own set of terms, interest rates, and repayment plans, making it essential for students to carefully evaluate their choices.

- Federal Loans: In the U.S., federal loan programs such as Direct Unsubsidized Loans and Grad PLUS Loans offer favorable terms including lower interest rates and flexible repayment options.

- Private Loans: Banks and credit unions provide private student loans, which may cover the remaining balance after scholarships and federal loans. However, these loans often come with higher interest rates and stricter repayment terms.

- Loan Forgiveness Programs: Some MBA graduates may qualify for loan forgiveness through public service or specific employment, further easing the financial load.

Process for Applying for Financial Aid

Navigating the financial aid process involves several steps to ensure that students maximize their funding opportunities.

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a critical first step for U.S. citizens and eligible non-citizens seeking federal aid. It determines eligibility for federal loans and grants.

- Research School-Specific Aid: Each business school has its own financial aid policies and application processes. Students should check the specific requirements and deadlines for scholarships and other aid offered by their chosen institutions.

- Prepare Supporting Documents: Many financial aid applications require documentation such as tax returns, income statements, and letters of recommendation, particularly for scholarship applications.

- Follow Up: After submitting applications, it’s important to keep track of statuses and respond promptly to any requests for additional information from financial aid offices.

Understanding the complete landscape of financial aid options is vital for any MBA student looking to manage their educational expenses effectively.

Return on Investment (ROI)

Investing in an MBA program can be a significant financial commitment, but understanding the potential return on that investment is crucial for prospective students. An MBA can lead to enhanced career opportunities, increased earning potential, and valuable networking connections. This section delves into the potential salary increases associated with MBA graduation, compares ROI across different programs, and shares inspiring success stories from alumni who have reaped the benefits of their educational investment.

Potential Salary Increases Post-MBA Graduation

The financial gains from obtaining an MBA can be substantial. Graduates often see significant salary increases immediately upon entering the workforce or advancing in their current careers. According to various studies, such as those conducted by the Graduate Management Admission Council (GMAC), the average salary for MBA graduates can exceed $100,000 annually, depending on the industry and geographic location. To illustrate, here are some average salary increases observed across several sectors after obtaining an MBA:

- Consulting: Many consulting firms pay starting salaries above $120,000 for MBA graduates, with bonuses that can reach up to 20% of the base salary.

- Finance: MBA graduates entering the finance sector often command salaries around $115,000, with potential bonuses that can significantly increase total compensation.

- Technology: Graduates in tech roles can expect starting salaries between $110,000 and $130,000, reflecting the high demand for skilled professionals in this industry.

- Healthcare Management: Those moving into healthcare administration can see salaries starting at approximately $100,000, with considerable growth potential.

These figures highlight the potential for a rapid return on investment through increased salary and opportunities post-graduation.

Comparative ROI from Different MBA Programs

When evaluating the ROI of various MBA programs, it’s essential to consider both the costs involved and the outcomes achieved by graduates. Programs can differ greatly in terms of tuition, duration, and perceived value. A comparative analysis can be beneficial. Here’s a breakdown of ROI based on costs and outcomes from three types of MBA programs:

| Program Type | Average Tuition Cost | Average Starting Salary | Estimated ROI (3 Years Post-Graduation) |

|---|---|---|---|

| Full-time MBA | $60,000 | $100,000 | Approx. 150% |

| Part-time MBA | $40,000 | $90,000 | Approx. 120% |

| Online MBA | $30,000 | $80,000 | Approx. 130% |

Each program type offers distinct advantages and disadvantages, but the potential for a strong return on investment remains present across all formats.

Success Stories of MBA Graduates

Real-world examples of MBA graduates underscore the program’s value. Many alumni have experienced significant advancements in their careers, showcasing the transformative potential of an MBA. For instance, Jane Doe, a graduate from a top-tier business school, transitioned from a mid-level marketing role to a senior management position at a Fortune 500 company, resulting in a salary increase from $70,000 to $130,000 within three years of graduating.Similarly, John Smith leveraged his MBA to pivot from engineering to a strategic management role within the tech sector, achieving a 200% salary increase in just five years.

These narratives not only reflect individual successes but also highlight the broader impact that an MBA can have on career trajectories, emphasizing the program’s role in unlocking new opportunities and achieving greater financial success.

Part-time vs Full-time MBA Costs

Choosing between a part-time and full-time MBA program can significantly impact your financial investment and time commitment. Each option has its distinct cost structure, which influences overall affordability and the return on investment in your education. Understanding these differences is key to making an informed decision based on your career goals and financial situation.The fees associated with part-time MBA programs are generally lower on a per-semester basis compared to full-time programs, but the duration of study is longer.

This means that while you may pay less in tuition at one time, the total cost can add up over several years. Conversely, full-time MBA candidates typically incur higher fees in a shorter timeframe but may benefit from a more immersive educational experience that could lead to quicker career advancements.

Cost Comparison Table

To illustrate the differences further, here’s a comparison of the time commitments and associated costs of both program types:

| Program Type | Duration | Typical Tuition Fees | Additional Costs | Total Estimated Costs |

|---|---|---|---|---|

| Full-time MBA | 2 years | $60,000 – $150,000 | Living expenses, books, supplies | $80,000 – $200,000 |

| Part-time MBA | 3-4 years | $30,000 – $100,000 | Living expenses, books, supplies (varies) | $40,000 – $120,000 |

The total estimated costs take into account not only tuition but also living expenses and other incidental costs that add up over the duration of the program.

“Part-time programs allow students to maintain their full-time jobs while pursuing their MBA, which can mitigate costs associated with lost income.”

Choosing a part-time MBA program may also have various financial implications. While the immediate tuition costs may seem more manageable, one must consider the opportunity cost of not progressing in one’s career as quickly as a full-time program may allow. However, part-time options provide flexibility, enabling professionals to continue working, which can help offset the costs of tuition through ongoing income.

Additionally, many employers offer tuition reimbursement or sponsorship for employees pursuing further education, which can alleviate some of the financial burdens involved with part-time study.In summary, it’s essential to weigh not only the monetary costs but also the potential earnings and career growth associated with each MBA study format. Assessing your personal and professional situation will guide you toward the option that offers the best value for your investment.

International MBA Program Fees

Source: mbaandbeyond.com

Pursuing an MBA as an international student involves navigating a variety of costs that can differ significantly from domestic programs. Understanding these variations is crucial for effective financial planning and making informed decisions about education abroad.Cost variations for international students in MBA programs typically arise from differences in tuition fees, which can be higher for non-residents. This is often due to the additional resources allocated for international services and support.

In many institutions, international tuition fees can range from 20% to 50% higher than those for domestic students, influenced by the school’s reputation, location, and program structure.

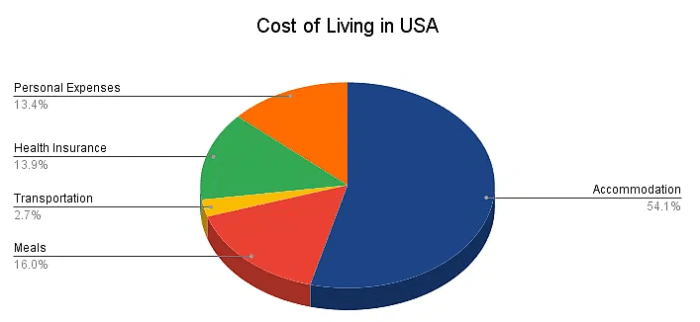

Additional Expenses for International Students

In addition to tuition, international students should account for several supplementary expenses that can add to the overall cost of their MBA journey. These include:

- Travel Costs: Airfare to and from the host country can vary greatly depending on the distance, time of year, and how far in advance tickets are purchased. Budgeting for travel expenses is essential, as they can range from a few hundred to several thousand dollars.

- Accommodation: Housing options can vary significantly in price and type, from university dorms to private rentals. Costs will fluctuate based on the city and neighborhood, with average monthly rent for a shared apartment ranging anywhere from $500 to $2,000.

- Living Expenses: Daily expenses including food, transportation, and healthcare should be factored in. Students should budget approximately $800 to $1,500 per month, depending on their lifestyle and the cost of living in their host country.

- Visa and Insurance Fees: Obtaining a student visa often involves application fees and additional documentation costs. Health insurance is also a mandatory requirement, which can add another $500 to $1,200 annually.

International Enrollment Trends and Impact on Fees, MBA Course Fees

The landscape of international enrollment in MBA programs has seen significant changes over recent years. According to data from the Graduate Management Admission Council (GMAC), the number of international students in MBA programs has been steadily increasing, with a 10% rise reported from 2022 to 2023. This growing demand can influence tuition fees and overall costs, as institutions seek to accommodate larger cohorts.Furthermore, the increasing diversity among international students can lead to enhanced resources and support services, which, while beneficial, may contribute to higher fees.

“Investing in an international MBA can yield substantial returns, but understanding the complete financial picture is essential for prospective students.”

Hidden Costs of MBA Programs

Source: formfees.com

Pursuing an MBA can be a significant investment, but the financial implications often extend beyond tuition and basic fees. Prospective students should be aware of several hidden costs that can accumulate throughout their studies. Understanding these expenses can help in planning and budgeting effectively.The financial landscape of an MBA program is not limited to tuition and books. Often, students encounter various lesser-known expenses that can impact their overall budget.

Networking events, conferences, and other opportunities for professional development frequently contribute to the total cost of an MBA, which can be substantial over time. Being aware of these potential hidden costs is crucial for prospective students aiming to make informed decisions about their education.

Hidden Expenses to Be Aware Of

While the advertised program fees may seem manageable, additional costs can arise that significantly alter the overall financial picture. Here are some hidden expenses to consider:

- Course Materials: Beyond textbooks, students may need specialized software or subscriptions to industry-specific journals that can add up.

- Networking Events: Attendance at industry conferences, seminars, and networking events often comes with registration fees, travel, and accommodation costs that can be quite high.

- Professional Development: Many programs encourage or require participation in workshops and training sessions that may not be included in the tuition.

- Technology Fees: Online resources, library access, and other technological support often come with associated fees that should be factored into the budget.

- Living Expenses: If attending a full-time program, students may need to consider the cost of living in a new city or area, which can vary greatly.

- Transportation Costs: Commuting to campus, especially for part-time students, can result in frequent fuel or public transport expenses.

- Health Insurance: Some programs require students to carry specific health insurance, which may require additional payment if not already covered.

- Graduation Fees: While students plan for tuition, they often overlook the costs associated with graduation ceremonies and related activities.

Trends in MBA Course Fees

Source: metromba.com

The landscape of MBA course fees has undergone significant changes over the past decade, reflecting shifts in educational priorities, economic conditions, and demand for graduate business education. Understanding these trends is essential for prospective students who are considering the financial implications of pursuing an MBA.Analyzing the fluctuations in MBA course fees reveals a pattern driven by various factors, including the rising costs of higher education, advancements in technology, and the evolving business environment.

Over the last ten years, many institutions have increased their tuition rates, often outpacing inflation. According to the Graduate Management Admission Council (GMAC), the average tuition for full-time MBA programs surged by approximately 30% from 2012 to 2022. This increase is largely attributed to the growing emphasis on quality education and the integration of innovative learning systems.

Impact of Economic Factors on MBA Tuition Rates

Economic factors play a substantial role in shaping MBA tuition rates. When the economy is strong, demand for MBA programs typically rises, leading institutions to raise their fees. Conversely, during economic downturns, schools may lower prices or offer more financial aid to attract students. Here are some notable influences on tuition rates:

- Inflation: As living costs rise, so do operational expenses for educational institutions, often resulting in increased tuition fees.

- Job Market Trends: A booming job market may lead to higher demand for MBA graduates, prompting schools to raise fees in response to increased enrollment.

- Government Funding: Changes in government funding and financial aid availability can directly affect tuition costs, influencing how institutions price their programs.

- Competitor Pricing: Schools often adjust their fees based on the tuition rates of competing institutions, aiming to remain attractive to potential students.

Predictions for Future Trends in MBA Fees

Looking ahead, predictions regarding MBA course fees suggest a continued upward trajectory, but with some potential shifts in how tuition is structured. Based on current data and trends, several forecasts can be made:

- Increased Flexibility: More institutions may adopt flexible pricing models, offering tiered tuition rates based on program delivery methods (online vs. in-person).

- Focus on Value: As competition intensifies, schools will likely emphasize the return on investment by showcasing graduate success rates and career advancement opportunities.

- Technological Integration: With the rise of online and hybrid MBA programs, institutions may lower tuition fees for these options to attract a broader range of students while still offering premium in-person experiences.

- Global Economic Influences: Exchange rates and international enrollment trends could significantly impact MBA fees in various regions, especially as schools seek to attract global talent.

In a nutshell, the evolution of MBA course fees can be attributed to a blend of economic factors and institutional strategies. As prospective students prepare for the financial commitment of an MBA, staying informed about these trends is crucial for making sound decisions about their education and future career paths.

Closing Notes

In summary, navigating the world of MBA Course Fees can be daunting, but with the right information, students can strategically plan their investments. Understanding the costs associated with various programs, exploring financial aid options, and anticipating hidden expenses will empower students to make the best decisions for their future. Ultimately, an MBA can be a valuable asset, and with careful planning, the financial aspect can be managed effectively.

FAQ Compilation

What are the typical tuition fees for MBA programs?

Tuition fees can range from $20,000 to $150,000 depending on the institution and program type.

Are there scholarships available for MBA students?

Yes, many universities offer scholarships based on merit, need, or specific criteria related to demographics or career goals.

Can I apply for financial aid for an MBA program?

Absolutely, students can apply for both federal loans and institutional financial aid to help cover costs.

Do international students pay higher fees for MBA programs?

Yes, international students typically face higher tuition fees, along with additional costs for travel and accommodation.

What are some hidden costs of MBA programs?

Common hidden costs include textbooks, networking events, and various administrative fees that may not be included in the tuition.